Did you know the cryptocurrency market cap peaks in the trillions? With such a colossal scale, it’s no wonder how to trade in different coins and cryptocurrency trading has become a hot topic in financial circles. Investors from all walks of life are turning their attention towards digital currencies, seeking the guidance of the best brokers for trading to navigate this exciting yet turbulent domain. The stakes are high, and the risks are real, but so are the opportunities for those equipped with the right coin trading rules. This comprehensive guide is designed to unravel the complexities of the trade, presenting proven ways and rules for trading that can help you thrive in the ever-evolving landscape of cryptocurrency.

Whether you’re well-versed in blockchain technology or just beginning to understand the ripple effect of Bitcoin’s surge, this article is your go-to resource for all things related to coin trading. Let’s embark on a journey that will demystify the digital currency market, underline the importance of strategic brokerage partnerships, and unfold the blueprint for trading success.

Key Takeaways

- The cryptocurrency market’s expansive capitalization underscores the need for strategic trading knowledge.

- Education on the various coins and the mechanics of cryptocurrency trading is paramount for investor success.

- Identification and utilization of the best brokers for trading are essential for a secure and efficient trading experience.

- Adherence to established coin trading rules can mitigate risks in a highly volatile market.

- Exploring diverse ways and rules for trading can enhance an investor’s approach to market engagement.

- Understanding liquidity, market depth, and fee structures is crucial when learning how to trade in different coins.

Understanding the World of Coin Trading

The rise of digital currency has ushered in a new era of financial transactions, where the ability to trade different coins has become a pivotal skill for investors. This segment sheds light on what coin trading entails, its potential rewards and risks, and profiles the archetype of a successful coin trader.

What is Coin Trading?

Coin trading is the exchange of cryptocurrencies, such as Bitcoin, Ethereum, and others on a cryptocurrency exchange. These online trading platforms enable investors to buy and sell cryptocurrencies using different fiat currencies or altcoins, providing a dynamic and accessible market for users around the globe. Especially for those keen on understanding this sector, a beginner’s guide to trading can pave the way to potentially lucrative investment opportunities.

The Pros and Cons of Cryptocurrency Trading

The allure of cryptocurrency trading lies in its unique benefits, including the freedom to access the market 24/7, the high liquidity of popular coins, and the potential for rapid returns. However, the flip side of this rapidly evolving market is its volatility, which can lead to abrupt price changes, and the ambiguous regulatory environment that can affect market stability and investment security.

“Cryptocurrency trading can be highly profitable, but it requires a solid strategy and a resilient approach to handle the market’s fluctuations.”

For discerning traders, it is imperative to weigh these pros and cons carefully before diving into the engaging world of coin trading.

Typical Profile of a Coin Trader

A successful coin trader often exhibits a keen insight into market trends, employing strong analytical skills and a disciplined approach to capitalize on market movements. Proficiency in technical analysis, a cool head to withstand market pressures, and the ability to adapt to new information are hallmarks of experienced traders. To effectively trade different coins, one must also be resilient and willing to continuously learn to remain competitive in the field.

A beginner’s guide to trading will typically highlight that, in addition to these traits, access to reputable online trading platforms is a necessity. These platforms equip traders with the tools necessary for informed decision-making and facilitate the smooth execution of trades. As such, selecting a reliable cryptocurrency exchange is a foundational step for anyone embarking on their coin trading journey.

Navigating Top Brokers for Cryptocurrency Trading

When venturing into the world of digital assets, finding the best brokers for your cryptocurrency endeavors is not only wise but necessary. Whether you’re a seasoned trader or new to the scene, these platforms play a pivotal role in your trading experience. Each broker boasts unique features aimed at optimizing your trades, offering a variety of tools and resources tailored to a diverse client base. Here are essential factors to consider on how to choose a trading platform that aligns with your trading needs.

One of the most critical aspects of broker selection is the reputation and security of the platform. As the industry has witnessed, not all platforms employ the same level of security measures, which can directly impact the safety of your funds. In addition to security, trading tools, and educational resources available can vastly influence trading outcomes. Consider the following cryptocurrency trading tips when comparing brokers:

- Assess the security protocols and history of the platform

- Examine the range and sophistication of trading tools offered

- Understand the fee structure – transparency is key

- Review the educational resources for continuous learning

- Ensure the platform’s customer support is responsive and effective

Now, let’s dive into a comparison of some top brokers in the market:

| Broker | Advanced Trading Tools | Competitive Fees | Security Measures | Educational Resources |

|---|---|---|---|---|

| Coinbase | Pro charting, price alerts | Vary by transaction type | Two-step verification, insurance | Learning platform with rewards |

| Binance | Comprehensive charting, API support | 0.1% trading fee, discounts available | Device management, multi-tier system | Academy videos, trading guides |

| Kraken | Futures trading, OTC desk | Volume-based fee schedule | Cold storage, PGP encryption | Webinars, podcasts, and blog posts |

Remember, the journey of finding the right broker is unique to each trader’s style and needs. Keep these tips and comparisons in mind to enhance your trading experience. Lastly, staying informed on the latest cryptocurrency trading tips can significantly improve your strategic decision-making and overall success in the digital currency markets.

How to Trade in Different Coins, Best Brokers, Ways and Rules for Trading

In the dynamic world of cryptocurrency, diversifying your portfolio by trading various coins is a wise strategy to mitigate risk. To navigate this multifaceted market with dexterity, one must be well-versed in trading strategies, the nuances of coin trading strategies, and the specifics of how to trade in different coins. Beginning with a solid understanding of market liquidity and broker fees, traders can refine their approaches for better financial outcomes. Let’s delve into the critical aspects that shape the trading experience.

Assessing Coin Liquidity and Market Depth

Liquidity, in the context of coin trading, refers to the ease with which a cryptocurrency can be bought or sold in the market without impacting its price. A coin with high liquidity is typically associated with a stable, less volatile market, making it a preferable choice for many traders. Market depth, meanwhile, indicates the market’s ability to sustain sizable orders without major price fluctuations.

Understanding these concepts is pivotal when crafting trading strategies for different coins. It guides decisions on which coins to include in your portfolio and determines the optimal timing for your trades. The liquidity and depth of a coin are influenced by factors such as trading volume, the number of active traders, and the spread between buying and selling prices.

Fees and Structures of Various Brokers

It’s no secret that the fees and cost structures imposed by cryptocurrency brokers can significantly affect your trading profitability. From transaction fees, and withdrawal charges, to maintenance fees, traders should be meticulous in understanding the cost implications of their brokerage platforms. Different brokers cater to various trading styles, with some offering flat rate fees while others employ a percentage-based structure.

- Maker vs. Taker fees: Brokers may differentiate fees based on whether a trader is adding liquidity to the market (maker) or taking liquidity away (taker).

- Deposit/withdrawal fees: These are charges associated with moving funds into or out of your trading account, which can vary widely across platforms.

- Spread costs: The difference between the buy and sell price of a cryptocurrency can also act as a hidden fee, affecting the effective transaction cost.

When comparing brokers, it’s essential to balance the fee structure with the services provided. Some platforms may offer reduced fees but lack advanced trading tools or customer support, impacting your trading strategies and overall experience. It is worth investing the time to scrutinize and compare the cost structures of diverse brokers to find an agreeable balance that matches your coin trading strategies.

As you acquire the knack for how to trade in different coins, you’ll discern that a keen understanding of liquidity and fees is fundamental. These deep insights, punctuated with robust trading strategies, can elevate your trading endeavors, ensuring that you’re well-equipped to face the dynamic and ever-evolving landscape of cryptocurrency trading.

Crafting Coin Trading Strategies for Success

As you delve into the world of cryptocurrency, understanding and developing potent coin trading strategies form the bedrock of your pursuits toward financial triumph. It’s not solely about heeding the latest cryptocurrency trading tips or blindly following the market; it’s about creating a methodical approach tailored to your investment goals and risk tolerance. In the pathways of digital currency trading, those who not only build but also adhere to trading rules for success often find themselves ahead of the curve.

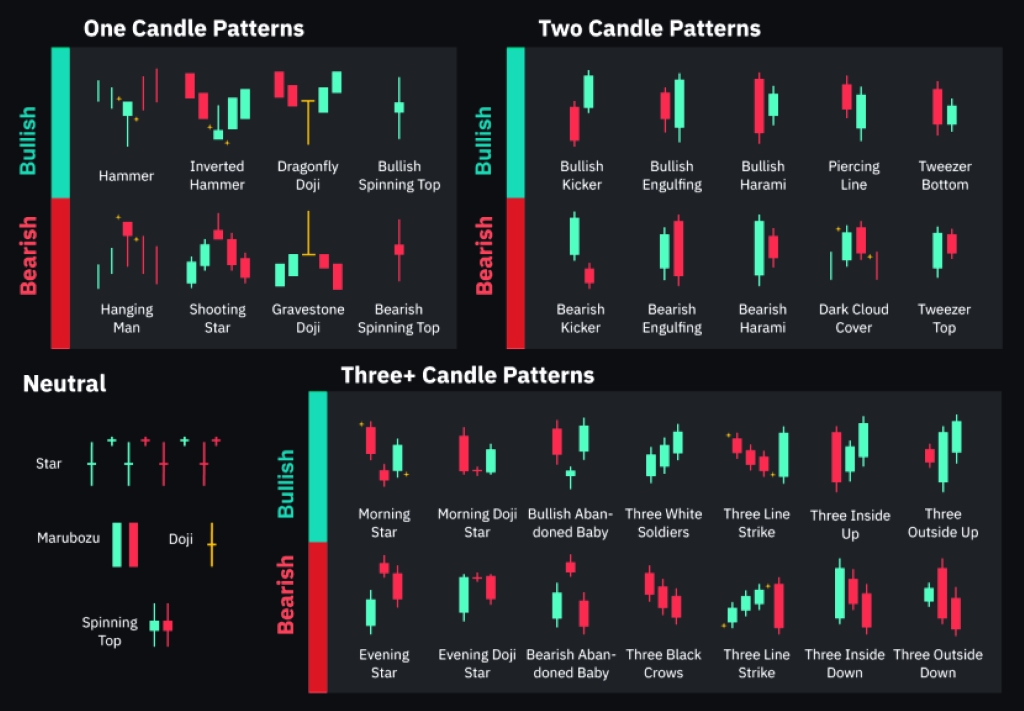

Technical Analysis for Trading Coins

One cannot overemphasize the importance of technical analysis in devising informed coin trading strategies. Mastery of charts, trends, and patterns gives traders the vantage point to forecast potential market movements and entry-exit points with greater accuracy. Grasping concepts such as moving averages, RSI (Relative Strength Index), and Fibonacci retracements can turn befuddling charts into comprehensible signals for executing trades.

Implementing Risk Management Techniques

Where there is potential for reward, there is inherent risk—and cryptocurrency trading is a prime exemplar of this tenet. To safeguard your capital, integrating effective risk management techniques into your trading regimen is crucial. Methods such as establishing stop-loss orders aid in mitigating losses during downturns, while prudent position sizing prevents overexposure to any single trade. Let’s not forget the golden rule: never invest more than you can afford to lose. It’s not about nullifying risks—instead, it’s about managing them adroitly to ensure you remain in the game for the long haul.

- Use stop-loss orders to limit potential losses

- Embrace position sizing to manage trade exposure

- Regularly re-evaluate your strategies to align with changing market conditions

- Stay informed on global events that might impact market sentiment

Essential Coin Trading Rules Every Trader Must Know

The realm of cryptocurrency trading presents a landscape of opportunity tempered with challenges. For novices and seasoned investors alike, abiding by certain cardinal trading rules for success is non-negotiable. In this beginner’s guide to coin trading, we unravel the threads of wisdom that weave the fabric of thriving trading practices.

Adhering to these rules can significantly augment one’s chances of success:

- Commit to ongoing education to keep abreast of market dynamics.

- Make analytical decisions over emotional reactions.

- Exercise meticulous due diligence before executing any trade.

Let’s delve deeper into these guiding principles:

“The most valuable commodity I know of is information.” – Gordon Gekko, Wall Street

Indeed, in the volatile domain of cryptocurrencies, information is king. A relentless pursuit of knowledge equips traders to make enlightened decisions amidst the cacophony of market noise.

- Analyzing market trends and technological advancements

- Engaging with community forums for crowd-sourced insights

- Understanding the geopolitical factors influencing market movements

Trading should be a discipline rooted in logic. Emotional trading decisions, whether spurred by fear, excitement, or the herd mentality, often lead to suboptimal outcomes.

Finally, due diligence is the armor protecting traders from the arrows of misinformation and deception. Scrutinize whitepapers, evaluate the leadership team of projects, and assess the problem a coin or token seeks to solve.

https://www.youtube.com/watch?v=4gh8JQyFELY

Here’s a table delineating some vital traits and actions that characterize successful cryptocurrency trading:

| Trait | Why It’s Important | Action |

|---|---|---|

| Diligence | Reduces the risk of fraud and errors | Research thoroughly before investing |

| Discipline | Encourages consistency and mitigates impulsive behavior | Develop a trading plan and stick to it |

| Patience | Helps in weathering volatility and avoiding premature decisions | Wait for the right opportunities to align with your strategy |

| Adaptability | Keeps traders competitive in a constantly evolving market | Be open to revising strategies in the face of new data |

By internalizing these trading rules for success, brokers of the digital realm can forge a journey marked by informed decision-making and strategic prowess—a true hallmark of accomplished cryptocurrency traders.

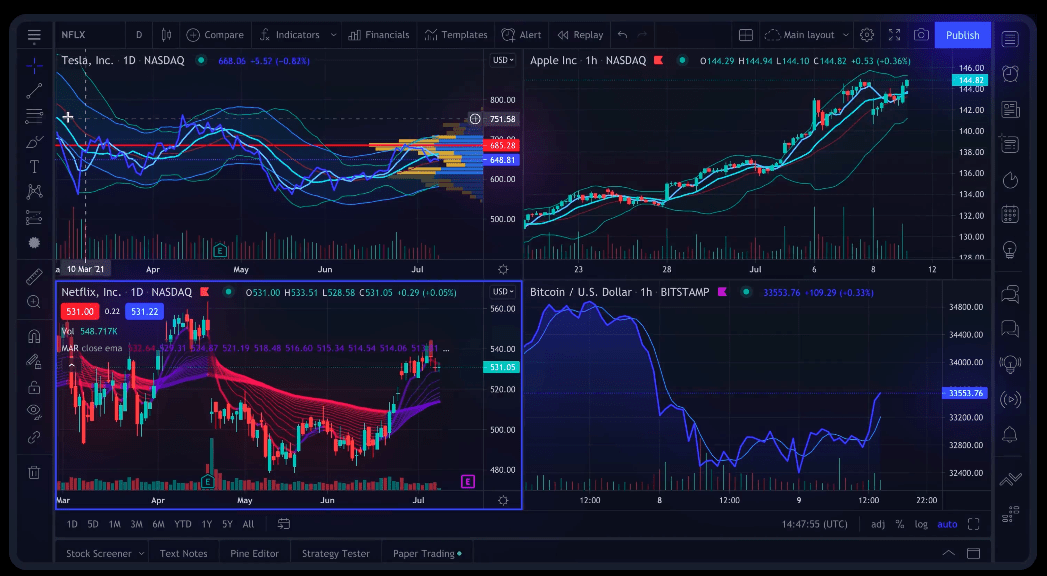

Examining Popular Online Trading Platforms

When scanning the horizon of available online trading platforms, investors are greeted with a vast array of options, each boasting unique features and tools. Critical to a trader’s decision is examining the inherent security protocols and user interface design. These two aspects significantly influence the overall trading experience and can be the difference between seamless trading and unnecessary complexity. Below, we evaluate several leading platforms, taking into account their commitment to safeguarding cryptocurrency exchanges and the ease with which traders of all skill levels can navigate their interfaces.

Platform Security Features

In a world where digital threats loom at every corner, the resilience of a platform’s security features stands paramount. Best brokers are acutely aware of this and invest heavily in both preventative and reactive security measures to ensure client assets are impervious to attacks. The use of two-factor authentication (2FA), end-to-end encryption, and regular security audits are benchmark practices adopted by the most trusted platforms.

User Interface and Usability

The design of a platform’s user interface is a key driver for a trader’s efficiency and comfort. A clutter-free and intuitive dashboard can enhance decision-making and order execution, whilst complexity and poor design can lead to costly mistakes. As part of our evaluation, we have compared the usability of some of the industry’s most popular tools.

| Trading Platform | User Interface Score | Key Security Features | Mobile App Availability |

|---|---|---|---|

| Coinbase | 9/10 | Biometric login, AES-256 encryption | Yes |

| eToro | 8.5/10 | 2FA, Cold storage of assets | Yes |

| Binance | 9/10 | Device management, Multi-tier system architecture | Yes |

| Kraken | 8/10 | Global settings lock, PGP email encryption | Yes |

A Beginner’s Guide to Navigating Coin Markets

Welcome to the exciting world of cryptocurrency trading! For those embarking on this journey, consider this section your beginner’s guide to trading. With the right coin trading tips, you’ll learn how to trade in different coins effectively even if you’re just starting.

Understanding the market’s intricacies can be likened to learning a new language – seemingly complex at first but ultimately rewarding with practice and patience. The trading market is a dynamic arena, full of opportunities and pitfalls. Our goal here is not only to educate but also to empower you with a foundation that can set you on a path to informed trading decisions.

The first step in your trading journey is to familiarize yourself with the key concepts and terms used in the markets. From understanding what a ‘bull’ and a ‘bear’ market means to grasp the significance of terms like ‘volatility,’ ‘liquidity,’ and ‘market capitalization,’ these are the building blocks that will support your trading decisions.

Remember, the journey of a thousand miles begins with a single step. – Lao Tzu

Now, let’s delve into some practical steps:

- Start by setting up a trading account with a reputable and user-friendly platform.

- Engage in continuous learning. There are ample resources online – from tutorials to forums where experienced traders share their insights.

- Begin practicing with a demo account. Many platforms offer this feature, allowing you to trade in real time with simulated money.

- When ready, start small. It will help you gain hands-on experience without taking on excessive risk.

- Stay updated with market news and trends. The cryptocurrency world evolves rapidly, so staying informed is critical.

With so many coins available for trading, it might be challenging to decide where to focus your efforts. Start by researching coins that have established market presence and credibility. Diversification is essential, but so is a well-researched approach. Monitor a few and learn their patterns.

Mistakes are part of the learning process, but here are common ones you should endeavor to avoid:

- Avoid investing money you can’t afford to lose.

- Don’t chase losses – understand when to cut your losses and when to stay the course.

- Steer clear of emotional trading. Making decisions based on fear or greed is a recipe for disaster.

Finally, the importance of strategy cannot be overstated. Your trading strategies should be a mix of technical analysis, market trends evaluation, and personal financial goals. Here’s a simple table to help you visualize some fundamental strategies:

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Day Trading | Trading positions are entered and exited within the same day. | Potential for quick profits, no overnight market risk. | Requires time, focus, and quick decision-making. |

| Swing Trading | Holding positions for several days to capitalize on expected upward or downward market shifts. | Less time-consuming, and allows for more in-depth analysis. | Overnight and weekend market risk. |

| Scalping | Making profits off small price changes with frequent buying and selling. | Opportunities for profit in stable markets reduced risk exposure. | Can be stressful, with high transaction costs. |

As you dive deeper into this beginner’s guide to trading, remember that knowledge is power—and patience is a virtue. Take your time to understand the mechanics of trading and the nature of the volatile coin markets. With dedication and persistent effort, you’ll grow from a novice to a seasoned trader, equipped to navigate the ebbs and flows of cryptocurrency trading.

How to Choose the Right Cryptocurrency Exchange

Embarking in the world of cryptocurrency trading requires a fundamental decision that can shape your trading experience: selecting an apt cryptocurrency exchange. With an array of platforms at your disposal, it’s crucial to discern and choose a trading platform that ticks all the right boxes for reliability, affordability, and security. Whether you’re a novice or an expert trader, the significance of trading with a credible platform cannot be overstated.

Evaluating Exchange Credibility

Trust is the cornerstone of any trading relationship, particularly in the digital sphere where anonymity can pose significant risks. The credibility of a cryptocurrency exchange is gauged through various factors including regulatory adherence, the presence of robust security protocols, and the responsiveness of customer support. Veteran traders typically lean towards platforms that not only comply with financial legislation but also provide transparent operational practices, limiting unforeseen issues down the line.

Exchange Rates and Hidden Fees

Financial efficiency is paramount in trading, hence being vigilant about exchange rates and hidden fees is non-negotiable. Even the best brokers for trading may have complex fee structures that could take a bite out of your profits if not understood fully. Scrutinize the transaction fees, withdrawal charges, and any other ancillary costs associated with your chosen platform. An informed trader inspects the fine print, ensuring that the profitability of trades is not compromised by overlooked expenses.

FAQ

What is coin trading and how does it work?

Coin trading is the practice of buying and selling cryptocurrencies on various platforms or exchanges. Traders can exchange one type of digital currency for another or fiat currencies. It works by leveraging the fluctuating prices of cryptocurrencies, aiming to buy low and sell high to make a profit.

What are the advantages and risks of cryptocurrency trading?

The advantages of cryptocurrency trading include market accessibility, the potential for high returns, and liquidity. However, risks include the volatile nature of the market, potential security threats, and the possibility of regulatory changes impacting the market.

Who typically trades in coins, and what skills are important?

Coin traders range from individual retail traders to professionals managing large portfolios. Essential skills include an understanding of market trends, analytical abilities, and the discipline to stick to a trading strategy.

How do I choose the best broker for trading in different coins?

When selecting a broker, consider factors such as their reputation, fee structure, the trading tools they offer, security measures in place, and educational resources. Compare these features across multiple brokers to find the best fit for your trading needs.

Can you explain liquidity and market depth in coin trading?

Liquidity refers to how quickly and easily a cryptocurrency can be bought or sold without significantly affecting its price. Market depth is a measure of the market’s ability to sustain relatively large market orders without impacting the price of the coin. Both are important for evaluating the stability and traceability of a cryptocurrency.

What are the different fee structures among cryptocurrency brokers?

Brokers might charge a spread, transaction fees, withdrawal fees, and occasionally, inactivity fees. Some brokers also have tiered fee structures based on trading volume or balance. It’s crucial to understand all potential costs to calculate profitability accurately.

How does technical analysis assist in trading cryptocurrencies?

Technical analysis helps traders to identify patterns and trends in price movements. By using charts and technical indicators, traders can predict potential future movements and make more informed decisions on when to buy or sell.

What risk management techniques are essential for coin trading?

Essential risk management techniques include setting clear entry and exit points, using stop-loss orders, managing position sizes, diversifying your portfolio, and only risking capital you can afford to lose.

What are some fundamental coin trading rules for success?

Necessary trading rules include staying informed on market trends and news, not making emotional decisions, setting realistic goals, managing risks effectively, and continually learning from both successes and failures.

How important is platform security when choosing an online trading platform?

Platform security is paramount. A secure trading platform will have strong encryption, two-factor authentication, wallet security, and other measures to protect users’ funds and personal information from cyber threats.

What should a beginner know before entering coin markets?

Beginners should understand the basics of blockchain and how cryptocurrencies work, familiarize themselves with market terms, start with a small amount of capital, and practice with a demo account before moving to live trading.

How can I evaluate the credibility of a cryptocurrency exchange?

Check the exchange’s history, read user reviews, and research any past security breaches. Also, verify their compliance with regulatory standards and the transparency of their operations.

What should I watch out for regarding exchange rates and hidden fees?

Look for exchanges with transparent pricing systems. Be aware of the difference between the listed exchange rates and the actual rates at which transactions are executed, as well as any additional fees for deposits, withdrawals, or inactivity.